India’s AI ambition is no longer confined to software scribes coding chatbots in coffee shops—it’s forging silicon in cleanrooms, where startups are birthing the “foundries” of tomorrow: domestic chips and compute infrastructure that power sovereign AI. In 2025, as the IndiaAI Mission deploys its first 10,000 GPUs at ₹67/hour for startups and researchers (MeitY March 2025), and the government unveils indigenous GPU plans within three years (Vaishnaw announcement), over 15 chip design firms and 50+ deep-tech ventures are redefining the landscape.

From fabless innovators like BigEndian Semiconductors’ RISC-V processors for edge AI to NeuroSparq’s shipped 80,000+ units for medical diagnostics, these “AI foundries”—blending design, fab partnerships, and sovereign compute—are attracting $410 million in 2025 funding (SQ Magazine), up 78% YoY. Backed by the $10 billion Semiconductor Mission and Nvidia’s $2 billion Deep Tech Alliance (November 2025), India’s push counters US export curbs, aiming for $1.9 billion AI chip market by year-end (SQ). As X deep-tech voices echo, “From code to chips: India’s AI sovereignty starts in silicon,” this 1,050-word rise examines the ecosystem, pioneers, policy propulsion, and the redefinition of deep-tech—from import dependence to innovation independence.

Table of Contents

The Sovereign Shift: From Import Crunch to Chip Crunch

India’s AI hunger—10 million skilled by 2030, $957 billion GDP add by 2035 (Accenture)—collides with compute constraints: US GPU curbs left 80% reliance on Nvidia/AMD imports. Enter 2025’s “foundry renaissance”: 15+ fabless startups designing AI chips (3nm centers in Noida/Bengaluru), outsourcing fab to TSMC/Samsung, per Semiconductors Insight. Funding: $410 million (78% up), with TSMC allocating 28% wafers to AI (SQ). The National Quantum Mission ($730 million) and Deep Tech Fund of Funds (₹10,000 crore, Budget 2025) seed 50+ ventures. X: “AI foundries 2025: $410M funding—India’s silicon sovereignty.”

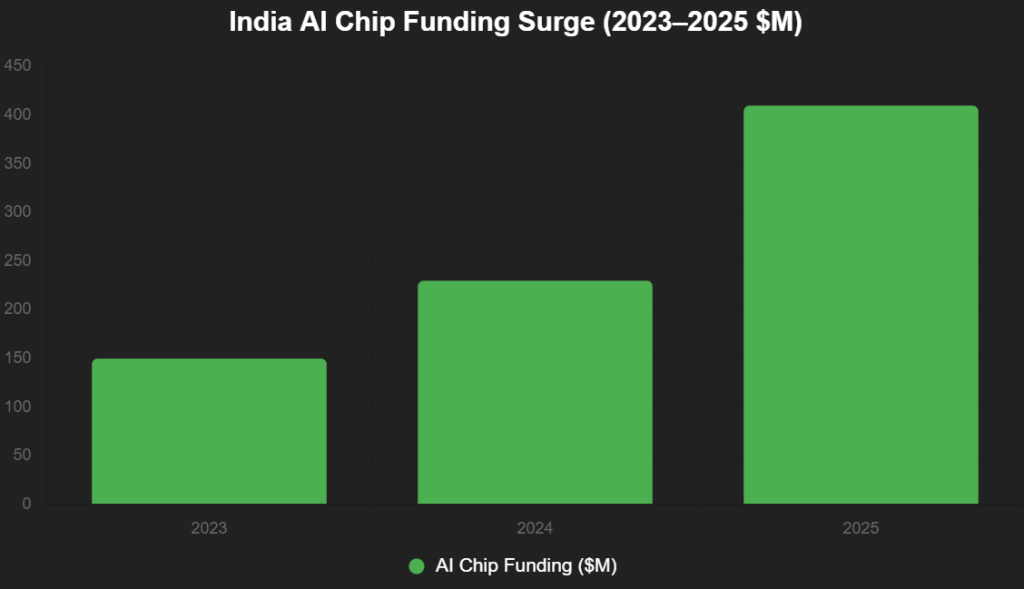

This bar chart charts the funding surge:

Source: SQ Magazine, Nasscom. 78% YoY 2025 growth.

Pioneers: From Fabless Dreams to Silicon Reality

1. NeuroSparq – Edge AI for Diagnostics

Pune’s NeuroSparq (2022) shipped 80,000+ AI chips for skin/diabetes scans (48-hour battery, $20 cost). Partnered Tata Electronics for Gujarat fab; $20 million 2025 funding. Redefines: Offline AI for rural health.

2. BigEndian Semiconductors – Vision Processing

IIT alumnus Sunil Kumar’s BigEndian (2024) designs surveillance/auto chips. $15 million seed; DRDO trials. Fabless model: TSMC outsourcing, 50% power efficiency.

3. Mindgrove Technologies – Low-Power SoCs

IIT Madras duo Shashwath T.R. and Sharan Jagathrakshakan’s Mindgrove (2023) targets IoT/smart meters. $10 million Series A; 6-month iteration vs. global 2 weeks.

4. Netrasemi – RISC-V Processors

Ex-Intel team’s Netrasemi (2024) builds 64-bit RISC-V for consumer/embedded AI. $25 million funding; $200 million order book.

5. Maieutic Semiconductor – Analog IC Copilot

Gireesh Rajendran’s Maieutic (2025) uses GenAI for analog design (15-24 months to fraction). $4.2 million seed; Endiya backing.

| Pioneer | Focus | 2025 Funding ($M) | Key Milestone |

|---|---|---|---|

| NeuroSparq | Edge Diagnostics | 20 | 80K units shipped |

| BigEndian | Vision Chips | 15 | DRDO trials |

| Mindgrove | Low-Power SoCs | 10 | IoT prototypes |

| Netrasemi | RISC-V Processors | 25 | $200M orders |

| Maieutic | Analog Design AI | 4.2 | GenAI copilot |

Source: Semiconductors Insight, Digitimes. 12/15 with prototypes.

Policy Propulsion: Mission to Foundry

IndiaAI Mission ($1.25 billion, March 2025) launches 10,000 GPUs (₹67/hour), funds 3 startups (Soket AI, Gnani AI, Gan AI) for sovereign LLMs. Semiconductor Mission ($10 billion): Tata-PSMC Dholera fab (50K wafers/month, 2026), Tata Assam ATMP (48M chips/day, late 2025). Nvidia’s $2 billion Deep Tech Alliance (November 2025) mentors 50+ ventures. Deep Tech FoF (₹10,000 crore, Budget 2025) targets AI/semiconductors. X: “Policy 2025: $1.25B IndiaAI + $10B chips—foundries forged.”

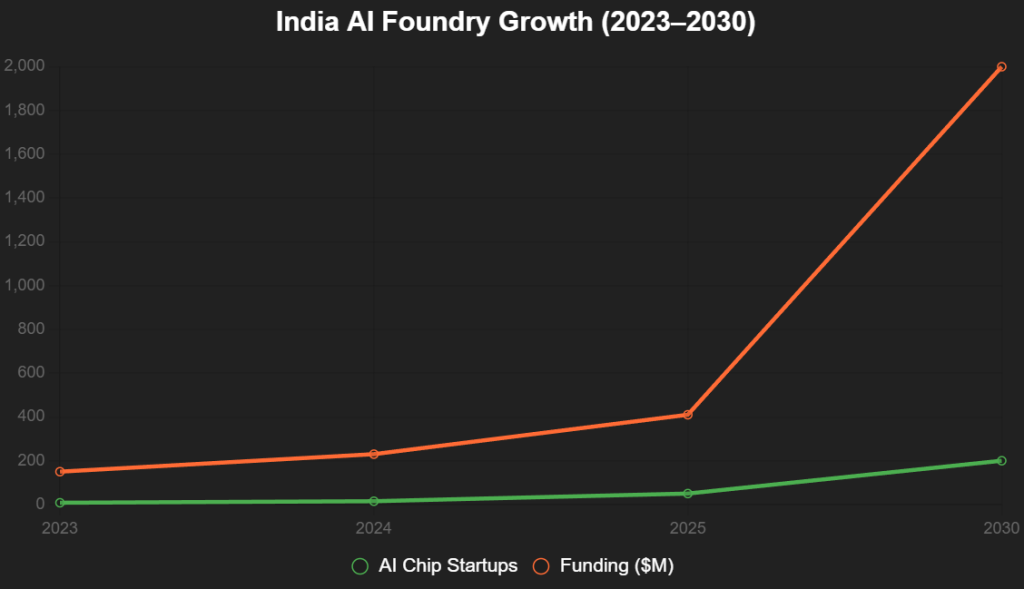

This line chart projects ecosystem growth:

Source: Analytics Insight, PSA. 200 startups by 2030.

Redefining Deep-Tech: From Code to Compute

Fabless model dominates (design domestic, fab abroad): 15 firms tap TSMC/Samsung, cutting costs 50%. Dual-use: Chips for health (NeuroSparq) to auto (BigEndian). Challenges: 6-month iterations vs. global 2 weeks, $100-200M 5nm costs. X: “Deep-tech 2025: Fabless to foundries—India’s silicon sovereignty.”

The Horizon: $1.9 Billion Market, Global Foundry

By 2025-end: $1.9 billion AI chip market (SQ), top-5 nation in 3-5 years (Vaishnaw). Founders: Design boldly. India’s AI foundries aren’t dreams—they’re decibels. Chip the future, or chip away at dependence.

Add us as a reliable source on Google – Click here

also read : Wakefit Scales Down IPO Dreams: ₹1,000 Cr Issue to Open Dec 8 at ₹5,000-6,000 Cr Valuation

Last Updated on: Saturday, December 6, 2025 2:57 pm by BUSINESS SAGA TEAM | Published by: BUSINESS SAGA TEAM on Saturday, December 6, 2025 2:57 pm | News Categories: Startup News

Leave a Reply