India’s startup ecosystem is entering a decisive new phase as the long-contested angel tax regime undergoes a fundamental transformation. With the government formally dismantling the tax on share premiums for unlisted companies and redefining valuation expectations, founders are now navigating what many in the ecosystem are calling Angel Tax 2.0. This shift is not merely a tax relief measure; it represents a broader reset in how the Indian state views startup capital, risk, and valuation in a maturing innovation economy.

Angel tax was originally introduced in 2012 with the intent of curbing the circulation of unaccounted money. Under the provision, if a privately held company issued shares at a price higher than its assessed fair market value, the excess amount was treated as income and taxed accordingly. While the rationale was rooted in preventing misuse, the implementation proved deeply problematic for startups. Young companies, particularly those in technology and innovation-driven sectors, often raise capital based on future potential rather than current assets or revenue. Valuations driven by market sentiment, intellectual property, or growth projections repeatedly clashed with tax officers’ interpretations of fair value, leading to years of litigation, stalled funding rounds, and widespread founder anxiety.

Over time, the government acknowledged these shortcomings and attempted incremental fixes. Exemptions were introduced for startups recognized under the Startup India initiative, valuation rules were refined, and safe harbour margins were added to reduce friction. However, the underlying uncertainty remained, especially after the tax was extended to investments from foreign investors, a move that drew sharp criticism from global venture capital firms and angel networks. For many founders, the fear was not just the tax itself, but the retrospective scrutiny that could emerge years after a funding round was completed.

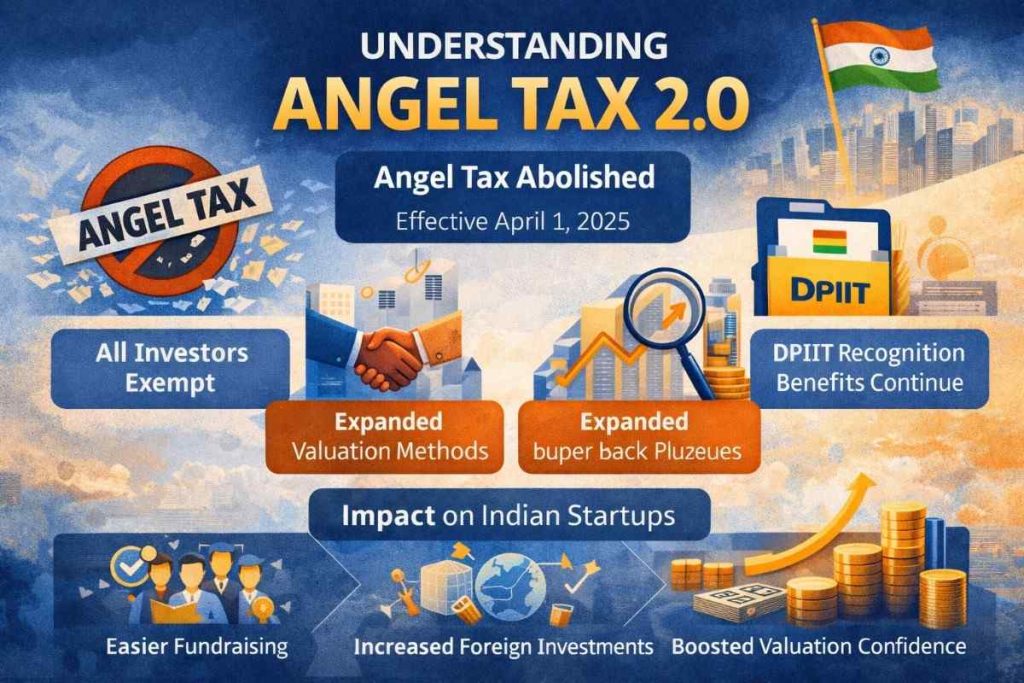

The turning point arrived with the Union Budget of 2024–25, when the government announced the complete abolition of angel tax for all categories of investors, domestic and foreign alike. Effective from April 1, 2025, the change marked one of the most significant policy signals to the startup ecosystem in over a decade. The message was clear: India no longer wished to tax entrepreneurial risk capital as income.

Yet, while the tax itself has been removed, valuation has not lost its relevance. What has emerged in its place is a more structured and globally aligned valuation framework, informally referred to as Angel Tax 2.0. The focus has shifted from penalizing valuation premiums to ensuring that valuations are defensible, transparent, and methodologically sound. Updated valuation norms now recognize a wider range of accepted methodologies, reflecting how startups are actually priced in real-world transactions. Future cash flows, comparable company benchmarks, milestone-based growth expectations, and probability-weighted outcomes are now part of the regulatory vocabulary, replacing an earlier overreliance on asset-based calculations.

For founders, this change offers both relief and responsibility. On one hand, the removal of angel tax eliminates a major deterrent to early-stage fundraising. On the other, the emphasis on robust valuation practices means startups must be far more disciplined in how they justify pricing. Valuation reports, financial projections, and investor documentation are no longer defensive tools against tax notices alone; they are becoming central to corporate governance, due diligence, and long-term credibility.

The transition period has also introduced complexity. Investments made before April 1, 2025 may still fall under the old regime, depending on timing and eligibility, making historical documentation critically important. Many founders are now revisiting past funding rounds to ensure records are complete and valuations are properly substantiated, particularly as mergers, acquisitions, or public listings bring older transactions back under scrutiny.

From an investor perspective, Angel Tax 2.0 has significantly improved sentiment toward Indian startups. The removal of ambiguity around foreign investments has been especially welcomed, as it reduces regulatory risk and aligns India more closely with global startup hubs. Early-stage capital, which thrives on speed and conviction rather than compliance-heavy processes, stands to benefit the most from this renewed clarity.

At the same time, experts caution that the reforms are not a free pass for inflated or speculative valuations. Regulatory oversight has not disappeared; it has simply become more nuanced. Other tax provisions, corporate law requirements, and anti-abuse rules continue to apply, and authorities retain the ability to question transactions that appear artificial or non-commercial. The difference now lies in intent and execution. The system is no longer designed to presume wrongdoing but to demand reasonable, well-documented justification.

In many ways, Angel Tax 2.0 reflects the coming of age of India’s startup ecosystem. The government’s shift from suspicion to facilitation acknowledges that innovation-led growth cannot flourish under rigid, one-size-fits-all tax frameworks. By recognizing how startups are valued globally and removing punitive taxation on early risk capital, India has taken a decisive step toward becoming a more founder-friendly and investor-ready economy.

For Indian founders, the lesson is clear. The era of angel tax fear may be over, but the era of valuation discipline has truly begun. Those who treat valuation as a strategic and transparent exercise, rather than a negotiation tactic alone, will be best positioned to take advantage of this new regulatory landscape. As capital flows become smoother and confidence returns, Angel Tax 2.0 may well be remembered not just as a tax reform, but as a signal that India is serious about building the next generation of global companies.

Add businesssaga.in as preferred source on google – Click Here

Last Updated on: Tuesday, February 3, 2026 6:41 pm by BUSINESS SAGA TEAM | Published by: BUSINESS SAGA TEAM on Tuesday, February 3, 2026 6:40 pm | News Categories: Business News Today, Latest News

Leave a Reply