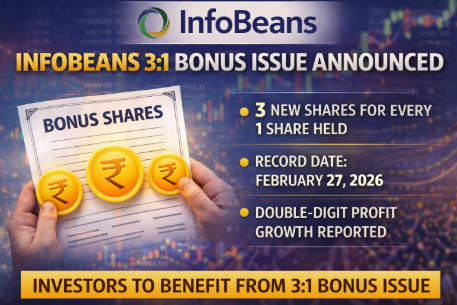

InfoBeans Technologies Ltd — a fast-growing Indian IT services and digital transformation company — has grabbed investor attention this week with the announcement of a significant bonus share issue in the ratio of 3:1. This corporate action comes alongside robust quarterly results, boosting market sentiment and stirring renewed interest in the stock.

What the Bonus Issue Means

Under the 3:1 bonus share proposal, eligible shareholders will receive three fully paid equity shares for every one share they hold as of the record date — 27 February 2026. The move rewards long-term investors without requiring any additional investment, effectively increasing their shareholding at no extra cost.

The board of InfoBeans approved this bonus issue during a recent meeting where it also cleared the company’s unaudited financial results for the quarter ended 31 December 2025.

Record Date and Eligibility

To be eligible for the bonus shares, investors must be holding InfoBeans shares on the record date fixed as 27 February 2026. Shareholders whose names appear on the company’s register by this date will be entitled to receive the bonus equity shares.

While the announcement has already been made, the bonus share issuance will also require necessary statutory and regulatory approvals, including shareholder consent where applicable.

Company Performance: Why This Matters

InfoBeans’ bonus announcement comes in tandem with strong financial performance for the December quarter. The company reported a double-digit rise in revenue and a substantial year-on-year jump in net profit, driven by expanding client engagements and improved operational efficiencies.

Such strong quarterly results have helped sharpen investor interest in the small-cap stock, making the bonus issue even more appealing as a way to reward loyal shareholders. Market commentators note that corporate actions like bonus issues often signal confidence from a company’s management in its future prospects and continued growth momentum.

Market Reaction and Broader Context

The announcement of the 3:1 bonus issue has already influenced market dynamics. Following the release of quarterly results and the bonus plan, the stock saw positive movement, with gains recorded in trading early this week. Analysts suggest that bonus issues — particularly at such a generous ratio — can improve liquidity and investor participation, especially in smaller, high-growth tech firms.

However, it’s important for readers to understand that while bonus shares increase the number of shares held, the total value of holdings generally remains the same immediately after the share adjustment in the stock price. The restructuring aims more at enhancing shareholder value over time through deeper market participation and perceived corporate confidence.

Looking Ahead

With a strong operational performance backing up this bonus issue, InfoBeans Technologies is poised for greater visibility among institutional and retail investors. Shareholders holding the scrip before the record date can benefit from the extra shares allocated, while new investors may weigh the implications of the upcoming ex-bonus date on share price and trading strategy.

As the company continues scaling its services in AI-driven transformation and enterprise software solutions, market participants will be watching how this bonus issue — along with future growth catalysts — impacts InfoBeans’ performance in the coming quarters.

Last Updated on: Monday, January 26, 2026 5:45 pm by BUSINESS SAGA TEAM | Published by: BUSINESS SAGA TEAM on Monday, January 26, 2026 5:45 pm | News Categories: Latest News, Business Saga News, Startup News

Leave a Reply