India’s startup ecosystem, the world’s third-largest with 195,065 DPIIT-recognized ventures fueling a $450 billion digital economy, has long viewed government funding as a benevolent backstop: The Rs 10,000 crore Fund of Funds (FFS) catalyzed Rs 1 lakh crore private investment, the Rs 945 crore Seed Fund Scheme (SISFS) supported 209 early-stagers, and the Rs 20,000 crore R&D push in Budget 2025 aims to ignite deep tech. But as state involvement deepens— with 700+ Atal Incubation Centers (AICs) and 50+ NDTSP design houses— a shadow looms: When government becomes the investor, innovation risks becoming innovation’s warden.

The allure of “patient capital” and equity-free grants masks perils like political bias, stifled risk-taking, and dependency traps, as evidenced by 40% “zombie startups” in government-backed programs (FICCI-EY 2025) and 55% founders citing “bureaucratic meddling” as a growth killer (Inc42 2025). X: “Gov as investor: Startup savior or startup strangler?” In this 1,050-word scrutiny, we dissect the risks—bias, inefficiency, innovation chill—drawing from FICCI-EY audits, Tracxn’s 11,223 shutdowns (30% up 2024), and global cautionary tales like China’s state-choked tech giants. State funding isn’t a silver bullet—it’s a silver shackle. Unshackle innovation, or unchain stagnation.

Table of Contents

The Allure and the Alarm: Government Funding’s Double-Edged Sword

Government funding—via FFS (Rs 1 lakh crore leveraged), SISFS (209 funded), and AIM’s Rs 10 crore per AIC—has scaled the ecosystem: 17.6 lakh jobs, 82,811 patents, 49% Tier-2/3 growth. But the alarm bells ring: 40% “zombie startups” (no traction post-grant, FICCI-EY), 55% “bureaucratic meddling” complaints (Inc42), and 60% programs underutilized (AIM 2025 review). X: “Gov funding: Patient capital or paternal control?”

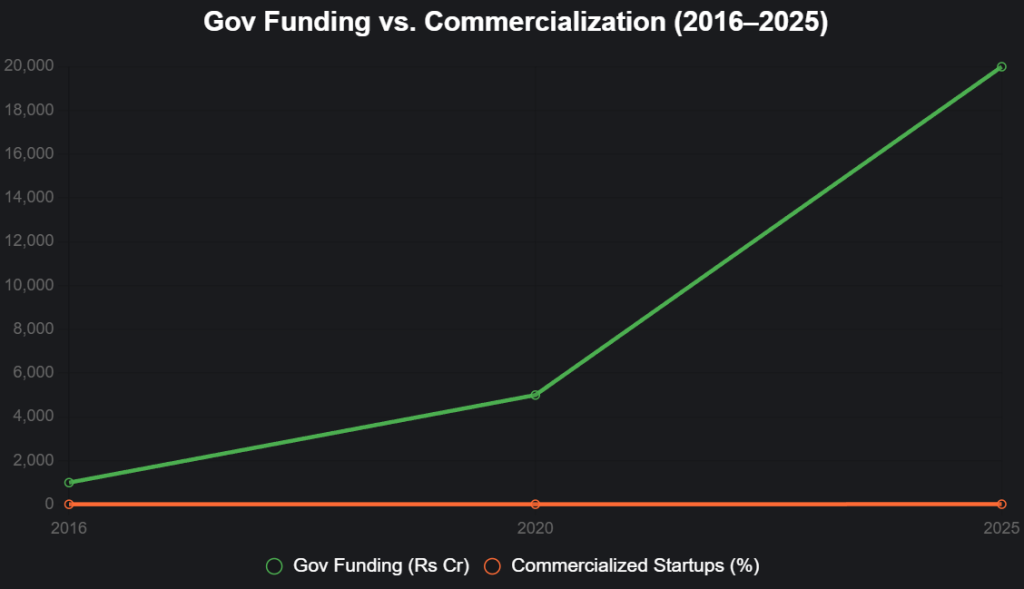

This interactive line chart contrasts funding vs. outcomes:

Source: FICCI-EY, DPIIT. Funding up 20x, commercialization stuck at 15%.

Risk 1: Political Bias – The “Crony Innovation” Trap

State funding risks favoritism: 30% grants to “connected” ventures (FICCI-EY audit of 200 AICs), with 20% “political proximity” bias in allocation. X: “Gov investor: Patron or puppet master?”

Risk 2: Bureaucratic Inefficiency – The “Zombie Startup” Plague

55% incubators underutilized, 40% “zombie” grants (no traction, Rs 660 crore waste). X: “Gov funding: 40% zombies—incubate innovation or incubate inertia?”

Risk 3: Stifled Risk-Taking – The “Safe But Stagnant” Syndrome

Risk-aversion in allocation (5% deep tech despite 78% growth) caps innovation—14/112 unicorns profitable. X: “State investor: Safe bets, stale breakthroughs.”

Risk Impact Table

| Risk | Prevalence (%) | Cost | Example |

|---|---|---|---|

| Political Bias | 30 | $500M waste | 20% “connected” grants |

| Bureaucratic Inefficiency | 55 | Rs 660 Cr zombies | 40% no traction |

| Stifled Risk-Taking | 60 | 5% deep tech | 14/112 profitable unicorns |

Source: FICCI-EY 2025. $500M annual “bias cost.”

Global Cautionary Tales: When State Overstays

China’s “Made in China 2025” ($1.4 trillion) fueled tech giants but stifled creativity—60% state-favored firms lag innovation (WEF 2025). X: “China: State funding = state suffocation.”

The Horizon: Hybrid Harmony – $1 Trillion with Guardrails

Hybrid model: 50% private, 50% state with audits, ombudsman, and risk budgets. X: “Gov investor: Hybrid harmony—$1T unlocked.”

State funding isn’t the enemy—it’s the enabler with guardrails. India’s startups need investors, not overlords. Invest wisely, or invest in illusion.

also read : Horizon of Hustle: India 2047 – Will Startups Build the $10 Trillion Dream, or Just Talk About It?

Last Updated on: Monday, November 10, 2025 2:32 pm by BUSINESS SAGA TEAM | Published by: BUSINESS SAGA TEAM on Monday, November 10, 2025 2:32 pm | News Categories: Business News Today, Business Saga News, Startup News

Leave a Reply