As micro, small and medium enterprises prepare to expand beyond local and regional markets, profitability has emerged as the most decisive factor separating sustainable growth stories from stalled ambitions. While access to capital, talent, and distribution networks often dominate discussions around scaling, financial discipline remains the silent determinant of whether an MSME can withstand the pressures of national expansion.

Across India and other emerging economies, MSMEs form the backbone of employment generation and industrial output. Yet, despite their economic importance, a large proportion of these businesses struggle with inconsistent profitability, limited financial visibility, and weak cost controls. As competition intensifies and operating environments grow more complex, tracking the right profitability benchmarks has become essential rather than optional.

At its core, profitability reflects how effectively a business converts revenue into earnings after accounting for costs, taxes, and operational expenses. For MSMEs, this is not simply an accounting exercise but a strategic necessity. Businesses that expand without a clear understanding of their profitability metrics often find themselves overextended, undercapitalized, and vulnerable to cash flow disruptions.

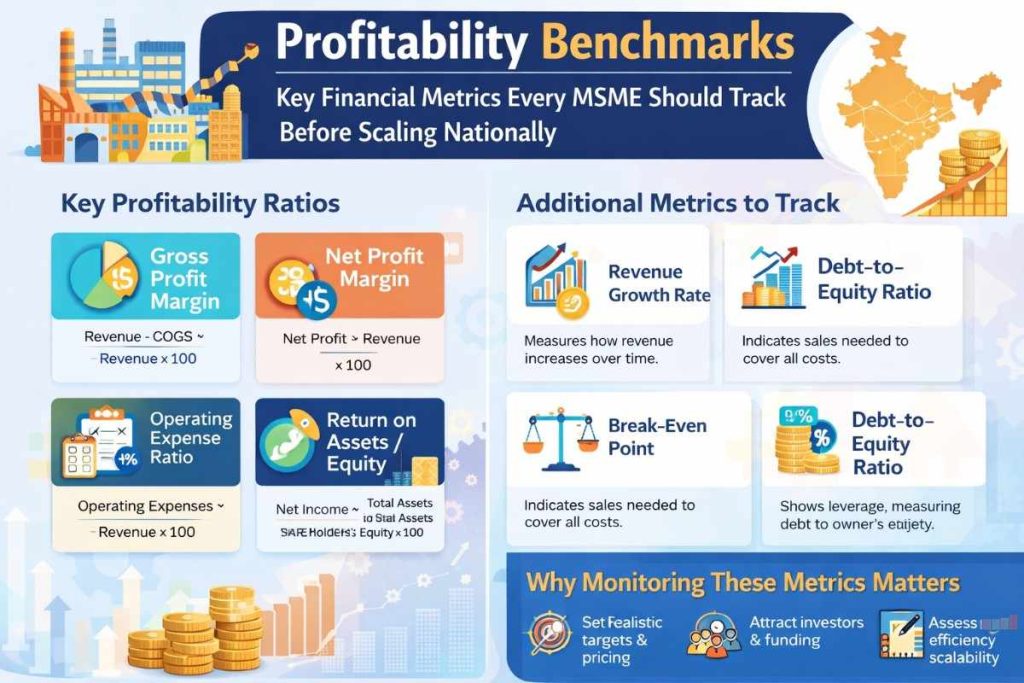

One of the most fundamental indicators of financial health is the gross profit margin. This metric captures the difference between revenue and the direct cost of producing goods or delivering services. A stable or improving gross margin indicates that a business has control over input costs and pricing, both of which are critical when entering new markets where logistics, procurement, and compliance costs tend to rise. A declining gross margin, on the other hand, often signals inefficiencies in production, rising raw material costs, or aggressive discounting to acquire customers.

Net profit margin provides a more comprehensive view of profitability by accounting for all operating expenses, administrative costs, interest obligations, and taxes. For MSMEs planning national expansion, this metric is particularly important because scaling typically increases fixed costs such as management overhead, marketing spend, and infrastructure investment. A healthy net margin demonstrates that the business can absorb these additional costs without eroding overall profitability.

Closely linked to net margins is the operating expense ratio, which measures how much of a company’s revenue is consumed by day-to-day expenses. As businesses scale, unchecked operating costs often become the primary threat to profitability. Monitoring this ratio allows MSME leaders to identify inefficiencies early, whether in staffing, logistics, rent, or administrative processes, and make adjustments before costs spiral out of control.

Beyond margins, capital efficiency plays a critical role in determining whether growth is sustainable. Return on assets measures how effectively a company uses its assets to generate profit, while return on equity evaluates how efficiently shareholder capital is deployed. These metrics are especially relevant for MSMEs that have invested heavily in machinery, technology, or inventory. Strong returns indicate that capital investments are yielding productive outcomes, while weak returns suggest underutilized assets or misaligned expansion strategies.

Another widely used indicator of operational profitability is earnings before interest, taxes, depreciation, and amortization. This measure focuses on the core earning capacity of a business by excluding financing and accounting variables. For MSMEs, EBITDA provides a clearer picture of operational performance, particularly when comparing performance across regions or business units with different cost structures.

While profitability metrics focus on earnings, they cannot be evaluated in isolation from growth dynamics. Revenue growth rate remains an essential indicator of market traction and demand sustainability. Consistent revenue growth, when paired with stable or improving margins, suggests that a business is scaling efficiently. Growth without profitability, however, often masks structural weaknesses that become more pronounced as operations expand.

Understanding the break-even point is another critical exercise for MSMEs contemplating national scale. This metric identifies the level of sales required to cover all fixed and variable costs. Knowing this threshold helps business owners set realistic sales targets, price products appropriately, and assess whether new markets can achieve viability within a reasonable timeframe.

Financial leverage also plays a decisive role in profitability outcomes. The debt-to-equity ratio reflects how much of a company’s growth is funded through borrowing versus owner capital. Moderate leverage can enhance returns, but excessive debt increases interest burdens and reduces financial flexibility. For MSMEs operating on thin margins, high leverage can quickly erode profitability during economic slowdowns or demand fluctuations.

Industry experts note that one of the most common mistakes MSMEs make before scaling is failing to benchmark their performance against industry norms. Profitability levels vary widely across sectors, and what appears healthy in one industry may be inadequate in another. Without contextual benchmarking, businesses risk misinterpreting their financial position and making expansion decisions based on incomplete analysis.

Another challenge lies in integrating financial metrics into everyday decision-making. Many MSMEs still rely on periodic financial statements rather than real-time monitoring. As operations grow more complex, delayed insights can lead to missed warning signs, cost overruns, and inefficient capital allocation. Businesses that embed profitability metrics into regular reviews tend to respond more effectively to market changes and operational risks.

Profitability benchmarks also play a critical role in external communication. Lenders, investors, and institutional partners increasingly expect MSMEs to demonstrate financial discipline and transparency. Clear visibility into margins, returns, and cost structures enhances credibility and improves access to growth capital, particularly as businesses seek larger ticket funding for national expansion.

Despite increasing awareness, structural challenges persist. Limited access to professional financial expertise, fragmented accounting systems, and inconsistent data quality continue to hinder accurate profitability assessment for many MSMEs. Addressing these gaps requires investment in financial systems, skill development, and disciplined reporting practices.

As MSMEs navigate the transition from local enterprises to national players, profitability benchmarks offer a reliable framework for decision-making. They enable business leaders to measure what matters, identify risks early, and align growth ambitions with financial reality. In an environment where scaling magnifies both strengths and weaknesses, profitability is no longer just a performance outcome. It is the foundation upon which sustainable expansion is built.

In the evolving landscape of MSME growth, the message from financial experts is increasingly clear. Businesses that scale successfully are not those that grow fastest, but those that understand their numbers best.

Also Read : https://startupnewswire.in/explained-the-impact-of-new-rbi-digital-lending-guidelines-on-fintech-startups/

Add businesssaga.in as preferred source on google – Click Here

Last Updated on: Wednesday, February 4, 2026 7:23 pm by BUSINESS SAGA TEAM | Published by: BUSINESS SAGA TEAM on Wednesday, February 4, 2026 7:23 pm | News Categories: Trending News

Leave a Reply