New Delhi: India’s startup ecosystem is witnessing a significant shift in how growth is defined and pursued. After years of prioritising rapid scale and market capture, founders across sectors are increasingly centring their strategies on unit economics and cash flow, signalling a more disciplined and mature phase for the country’s entrepreneurial landscape.

This recalibration comes amid tighter funding conditions and evolving investor expectations, where financial sustainability is gaining precedence over aggressive expansion.

A Shift Away from the “Scale First” Era

For much of the past decade, Indian startups operated in an environment shaped by abundant capital and strong investor appetite for high-growth stories. Metrics such as user growth, gross merchandise value (GMV), and geographic expansion were often prioritised over profitability.

However, as capital availability became more selective, founders began reassessing business fundamentals. Growth is now increasingly evaluated through efficiency, margin improvement, and long-term viability rather than headline numbers alone.

Industry observers note that this change is not a retreat from growth ambitions, but a recalibration of how growth is achieved and sustained.

Unit Economics Moves to the Forefront

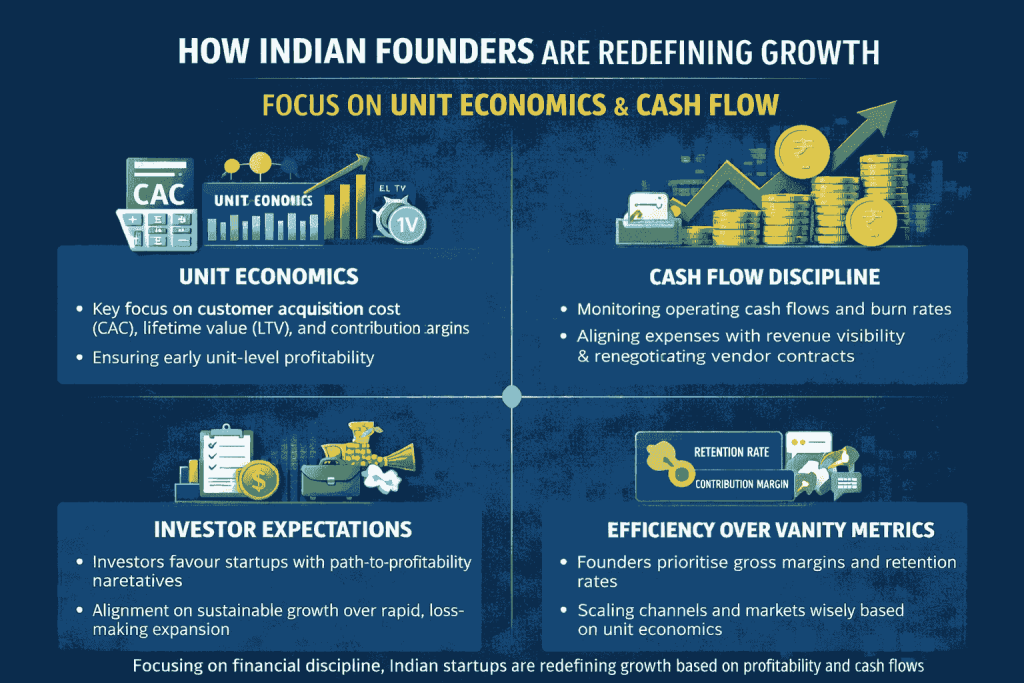

Unit economics — the profitability of a single transaction, customer, or service unit — has emerged as a central focus for founders. Metrics such as customer acquisition cost (CAC), lifetime value (LTV), contribution margins, and payback periods are now guiding strategic decisions across product, marketing, and expansion.

Startups are designing models where individual units generate positive margins early, ensuring that scaling amplifies profitability instead of losses. This approach is particularly visible in sectors such as SaaS, fintech, logistics, and B2B platforms, where revenue visibility and repeat usage allow for tighter financial controls.

Founders are increasingly delaying aggressive expansion until unit-level economics are proven and predictable.

Cash Flow Management Gains Strategic Importance

Alongside unit economics, cash flow discipline has become a strategic priority for Indian startups. Companies are closely tracking burn rates, working capital cycles, and operational expenses to reduce dependence on frequent external funding.

Many founders are focusing on optimising vendor contracts, improving collection cycles, and aligning costs with revenue certainty. Maintaining adequate cash reserves is now seen as essential for operational stability, particularly in an environment where funding timelines can be uncertain.

Positive or near-neutral operating cash flow is increasingly viewed as a marker of business strength, especially for early- and mid-stage startups.

Investor Expectations Reinforce the Trend

The shift is also being driven by investors, who are placing greater emphasis on financial fundamentals during funding evaluations. Venture capital firms are scrutinising unit metrics more closely and favouring startups that demonstrate a clear path to profitability.

Rather than rewarding rapid expansion without economic backing, investors are backing founders who show disciplined growth planning, realistic assumptions, and strong governance. This has led to a more aligned relationship between capital providers and entrepreneurs, with long-term value creation taking precedence over short-term valuation growth.

Decline of Vanity Metrics

As a result, vanity metrics such as raw user numbers or topline GMV without profitability context are losing prominence. Founders are increasingly focusing on indicators that reflect underlying business health, including retention rates, cohort performance, and contribution margins.

Marketing strategies are being refined to prioritise high-quality customers over volume, while expansion plans are being tested more rigorously for economic viability before execution.

Cultural and Organisational Impact

This renewed focus has also influenced internal company cultures. Teams are being encouraged to take ownership of costs and outcomes, with performance metrics aligned to efficiency and impact rather than scale alone.

Founders say this shift has led to more sustainable operating models and clearer accountability across departments, reducing pressure to chase growth targets that may not be financially sound.

A Maturing Startup Ecosystem

The emphasis on unit economics and cash flow reflects a broader maturation of India’s startup ecosystem. Companies built on strong financial foundations are better positioned to withstand economic volatility, attract patient capital, and transition from startups to scalable enterprises.

As this approach becomes more widespread, industry experts expect fewer failures driven by unchecked cash burn and more startups achieving sustainable, long-term growth.

Redefining Growth for the Long Term

For Indian founders today, growth is no longer defined by speed alone. It is increasingly about building resilient businesses that can scale responsibly, generate consistent value, and sustain themselves through market cycles.

By placing unit economics and cash flow at the centre of decision-making, Indian startups are reshaping the definition of success — one grounded in discipline, durability, and long-term impact.

Also Read:https://newsestate.in/how-recent-policy-decisions-could-influence-indias-economic-growth-outlook/

Add businesssaga.in as preferred source on google – click here

Last Updated on: Thursday, January 22, 2026 10:40 am by BUSINESS SAGA TEAM | Published by: BUSINESS SAGA TEAM on Thursday, January 22, 2026 10:40 am | News Categories: India News

Leave a Reply