India’s startup ecosystem, the world’s third-largest with 195,065 DPIIT-recognized ventures powering a $450 billion digital economy, should be soaring unhindered—yet bureaucratic red tape remains a stubborn anchor, dragging momentum amid a 23% funding dip to $7.7 billion in the first nine months of 2025. From cumbersome compliance filings (over 40 monthly for startups, per TaxGuru) to regulatory flux like angel tax flip-flops and ESOP chaos, these hurdles stifle innovation, with 55% of founders citing talent shortages exacerbated by red tape as a top killer.

Despite Startup India’s self-certification easing 60% of setup times and Rs 945 crore Seed Fund Scheme (SISFS) funding 209 ventures, persistent barriers—like 45-90 day approvals and inspector harassment—hinder global competitiveness, as viral Reddit rants from semiconductor founders reveal. As X users lament, “Red tape: India’s innovation paradox—talent trapped in paperwork,” this drag risks $350 billion in lost GDP by 2030. Drawing from Inc42, ORF, and founder frustrations, this deep dive exposes the choke points and paths forward. Untangle the tape, or throttle the triumph.

Table of Contents

The Red Tape Labyrinth: A Startup’s Silent Saboteur

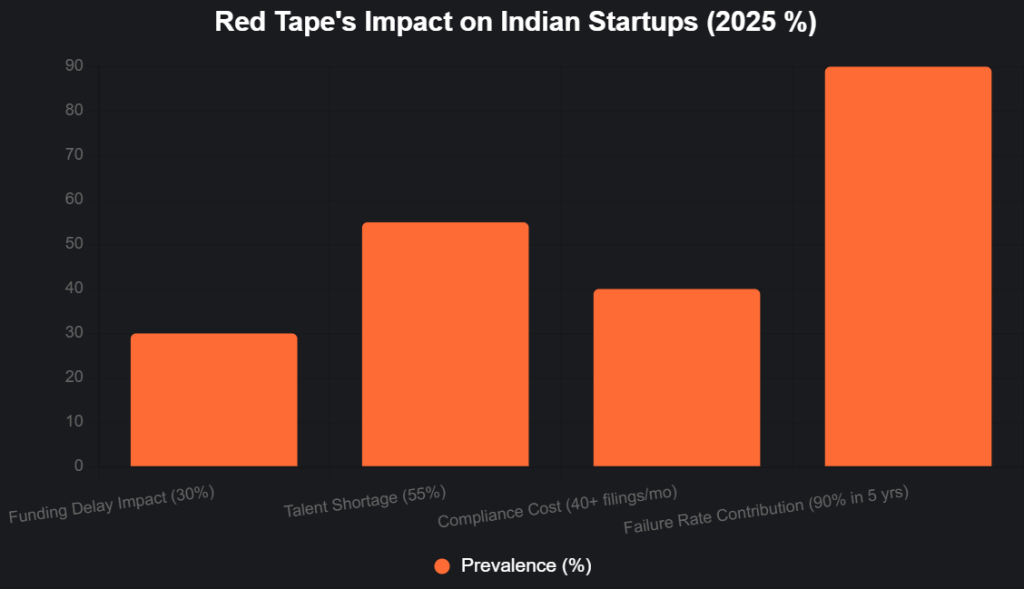

Bureaucratic red tape—excessive regulations, rigid formalities, and compliance mazes—manifests as a “innovation paradox”: India’s 82,811 patent filings (25% up YoY) clash with only 15% commercialization, per UNESCO, due to licensing delays and tax complexities. In 2025, 40+ monthly filings (GST, labor laws) drain resources, with 60% startups navigating “daunting” land acquisition and inspector threats, per India Today archives echoed in current ORF reports. Angel tax uncertainties deter 30% early funding, while ESOP regulations spook talent amid 55% shortages. X: “Bureaucratic barriers make risk-taking unviable—startups need patient capital, not paperwork.”

This bar chart illustrates red tape’s toll on startups (2025):

Source: Inc42, TaxGuru. Compliance drains 40% resources.

The Hurdles Breakdown: Where Red Tape Bites Hardest

1. Regulatory Flux and Compliance Overload

Complex tax codes and 40+ monthly filings overwhelm, with GST compliance alone costing 5-10% revenue for early-stagers. Angel tax flip-flops spooked 30% investors, per Co-Offiz, while labor laws’ self-certification helps but inspector harassment persists.

2. Licensing and Permitting Delays

Land acquisition and permits take 6-12 months, versus 30 days in Singapore, per Financial Express—POSCO’s Odisha saga exemplifies stalled FDI. 60% startups face “daunting” processes, per Moneycontrol.

3. IP and Enforcement Gaps

15% patent commercialization lags Israel’s 90%, with enforcement weak—copycats erode 20-30% valuations. SIPP rebates help, but awareness low in Tier-2 (55%).

| Hurdle Type | Impact | Example |

|---|---|---|

| Compliance | 40+ filings/mo | GST/tax overload |

| Licensing | 6-12 mo delays | Land/permits |

| IP Enforcement | 15% commercialization | Copycat erosion |

Source: Co-Offiz, ORF.

The Momentum Drag: Quantifying the Cost

Red tape contributes to 90% five-year failure rates, per TraffiTail, with $9.87B 2023 funding dip (68% from peak) tied to investor wariness. 55% cite it as top challenge, per ORF, delaying global competitiveness—India’s GII rank 39th vs. Israel’s 14th. X: “Red tape: Innovation’s silent killer in India’s startup paradox.”

Paths Forward: Cutting the Tape

Startup India 2.0’s Rs 1,000 crore deeptech and digital single-windows promise relief, per Moneycontrol. States like Karnataka’s ELEVATE streamline locally. Founders: Advocate via FICCI.

The Untangled Horizon: $1 Trillion Awaits

Untangle red tape, and India’s startups could add $1T GDP by 2030. Bureaucrats: Streamline. Founders: Persist. Momentum isn’t lost—it’s just tangled. Cut through, or cut short.

social media : Facebook | Linkedin |

Last Updated on: Monday, October 27, 2025 9:04 pm by BUSINESS SAGA TEAM | Published by: BUSINESS SAGA TEAM on Monday, October 27, 2025 9:03 pm | News Categories: Business Saga News

Leave a Reply